Introduce

Hello, I am Hoàng Phan, you can call me “King” in English. This is my very first blog post written in English. I hope you find it clear and enjoyable to read! 😀

Today I want to share what I did research about pump.fun

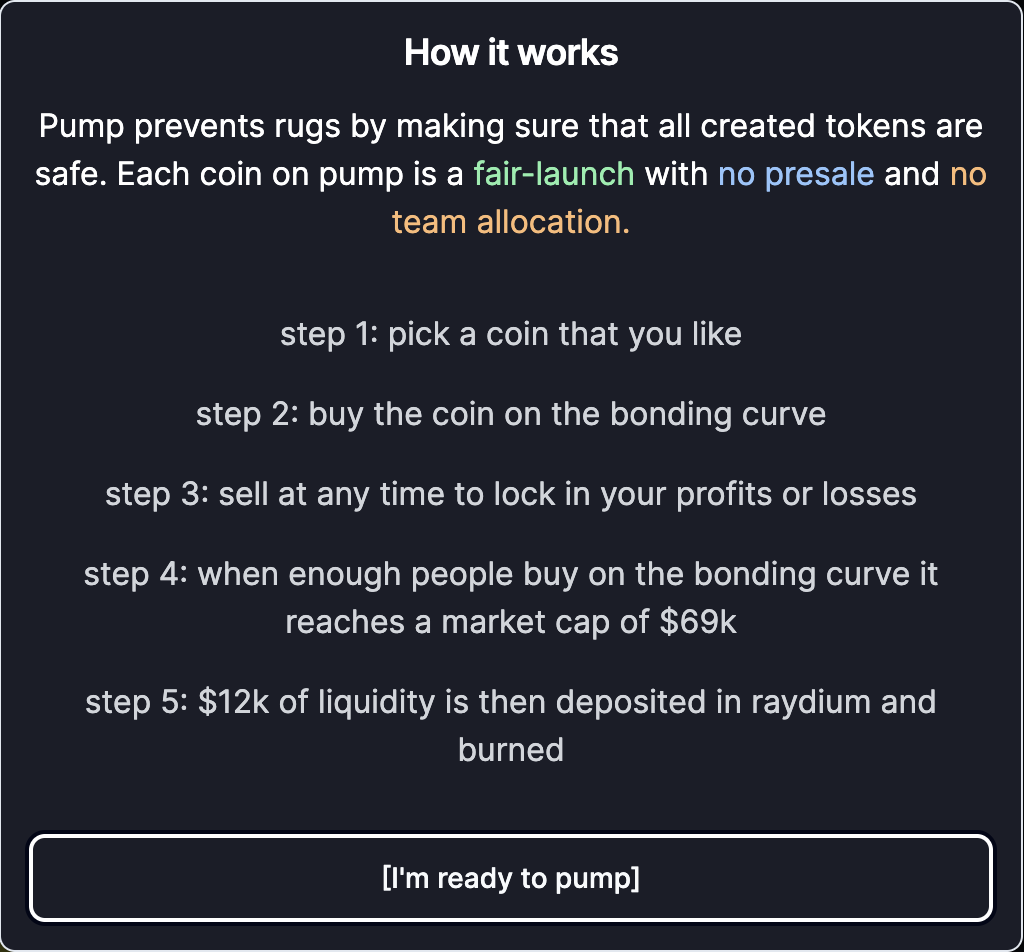

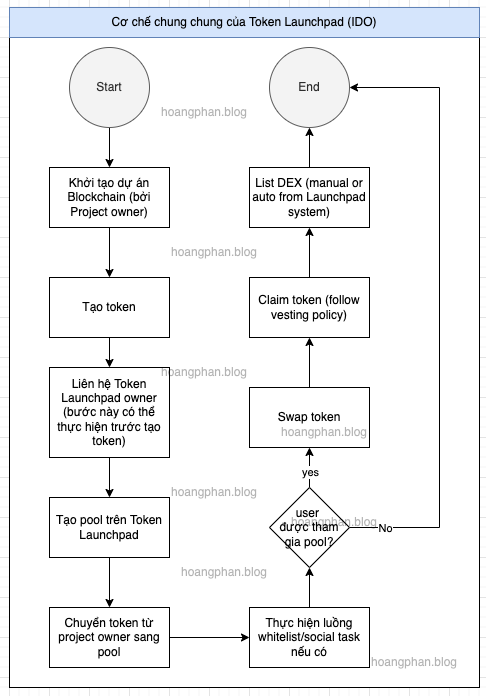

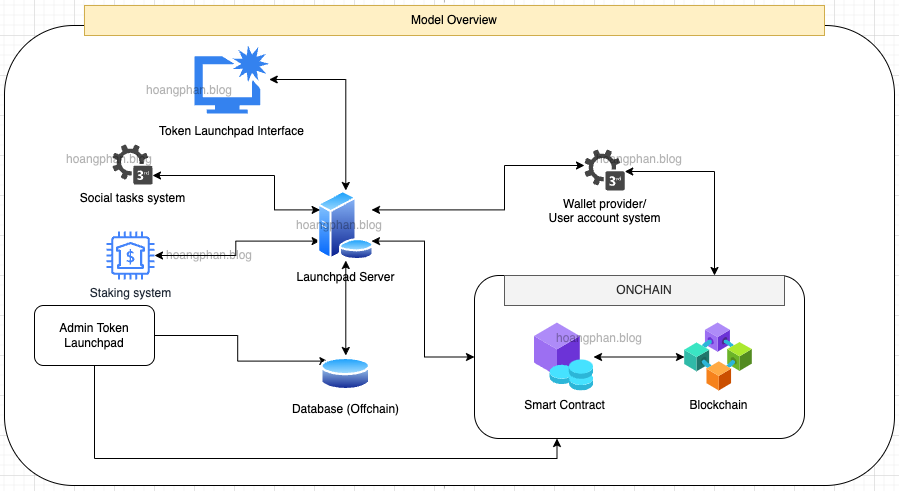

Overview

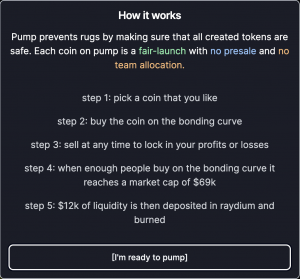

Pump.fun is a project on the Solana blockchain designed to facilitate fair fundraising for MEME coin through the use of a linear bonding curve mechanism.

I researched & asked pump.fun about the bonding curve, they told me that their bonding curve is similar to Uniswap V2 where x*y = k represents a linear bonding curve. This coin allows for dynamic pricing influenced by market demand and supply.

Target to raise to 85 SOL with 796M Meme tokens and add LP pair to DEX, and burn the LP token and the MEME coin has no owner.

While user joining the launchpad, user can change their mind to sell their tokens/shared back to Bonding Curve.

Create MEME COIN

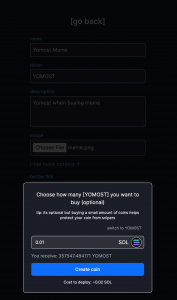

- Before creating any Meme coin, the creator must first establish a Solana wallet, deposit some SOL (at least 0.021 SOL for creating fee) into it, and then register an account on pump.fun.

- Creator fills out Ticker, meme name & description ⇒ Then choose the number of token to buy right after token created (First buy in SOL ⇒ Tokens [optional])

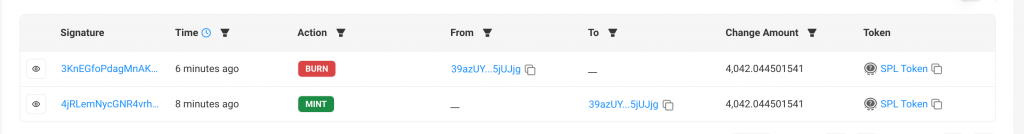

- The system will create/mint 1B Tokens

- Add 794M Tokens to Bonding Curve

- 206M Token is used to create Pair on TOKEN/SOL on Raydium and Add LP there if the bond can fill.

- A creating memecoin trx: https://solscan.io/tx/47b7uSUSq2frbahBthxjKg8VqaxvrDkN22nzz2ukqwwxyBLNtW49UsSKa7grJEYH59MB2PFnRhWEgY42WQ8JNANF

Trade

- If creator set first buy (in SOL) ⇒ Bonding Curve will execute the swap for that first buy

- The price will increase when more SOL & less Tokens in Bonding curve (more buy ⇒ gain price, and more sell ⇒ dump price, it follows the rule of Uniswap V2 Bonding Curve

x*y = k) - 1% fee for buy/sell actions, it will come to pump.fun team’s wallet

- example buy 1 SOL, you will pay 1 SOL + 0.01 SOL (1% fee)

- sell and receive 1 SOL ⇒ user can only receive 99% of 1 SOL = 0.99, then 0.01 SOL (1% fee) will be sent to pump.fun team’s wallet

List on Raydium

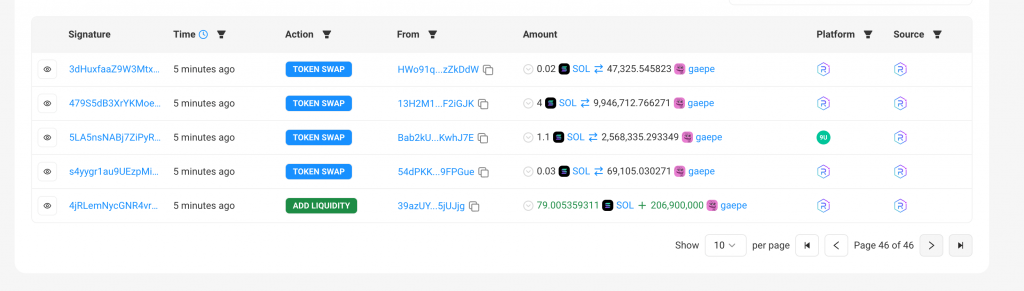

- Once the bond reaches 100% (0 TOKEN & 85 SOL in bonding curve) ⇒ (maybe) a cronjob will run & execute to create pair on Raydium & add LP

- 6 Sol will be taken for fees (2 to pump, 4 to Raydium), then 79 SOL + 20% of tokens (206m) will seed the LP.

- https://github.com/warp-id/solana-trading-bot/issues/116

- Bonding Curve ⇒ Transfer 85 SOL to wallet

39azUYFWPz3VHgKCf3VChUwbpURdCHRxjWVowf5jUJjgthen this wallet will transfer to the team’s wallet 2 SOL (deduct fee ⇒ 1.85 SOL) & create PAIR + Add LP (79 SOL + 206M Tokens)

- Right after add LP ⇒ they are will be burned ⇒ No one owner

- Update the UI on pump.fun after Raydium listing, so now user can trade on Raydium via pump.fun & see the new chart of pair TOKEN/SOL on Raydium. => can check the UI here: https://pump.fun/GzqmrcsvGkAiTpJrYTYav2j5F3NquE3x1gcDR71Jpump

Some other features

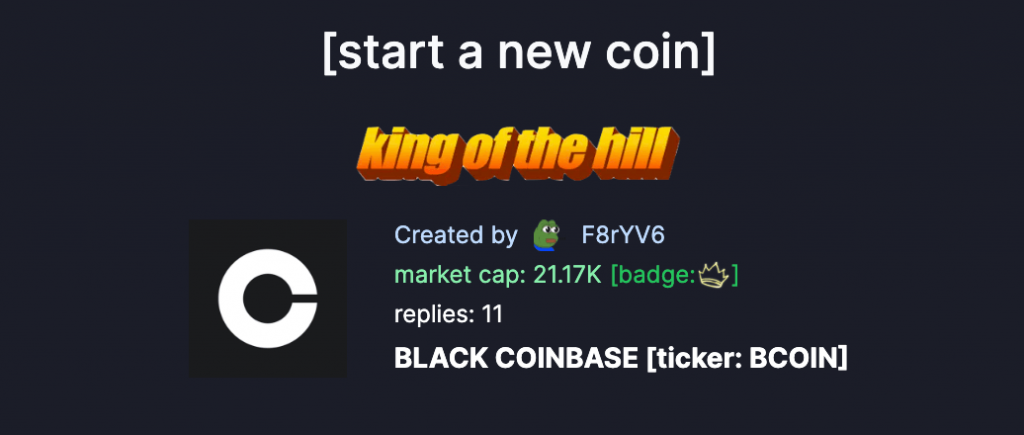

- King of the hills: To achieve “King of the Hill” status, about 45 SOL is required, marking the halfway point in token sales.

King of the hill on pump.fun When a token’s market cap hits around $30K, it overtakes the current “King of the Hill” and is featured prominently. This visibility often attracts new buyers but can also be exploited by scammers.

- Thread: This is using for discussing about the project, user can comment/replies free even you did not buy/invest to that tokens.

- Bubble Map: just use the framework to show the address & token’s holding.

Marketcap

I just copy message from pump.fun team wrote to me for question asking about how to calculate MC on pump.fun.

Market cap :

initial_virtual_sol_reserves / initial_virtual_token_reserves * total_supply

We have virtual (non real) reserves for both Sol and tokens. This sets the parameters and initial price in the bonding curve. The market cap is the initial ratio (price) of the virtual Sol and tokens multiplied by the total supply of tokens.

Understand more about bonding curve

You can read on this one to understand more about the bonding curve: https://docs.mint.club/tools/bonding-curve-design

Clone this project on other chains

Pump.fun already launched it on Blast chain, there is not too much volume.

And other teams also are the copy cat of pump.fun such as:

https://degen.day/

https://www.degen.fund/

So you can also follow this project to build your own product too.

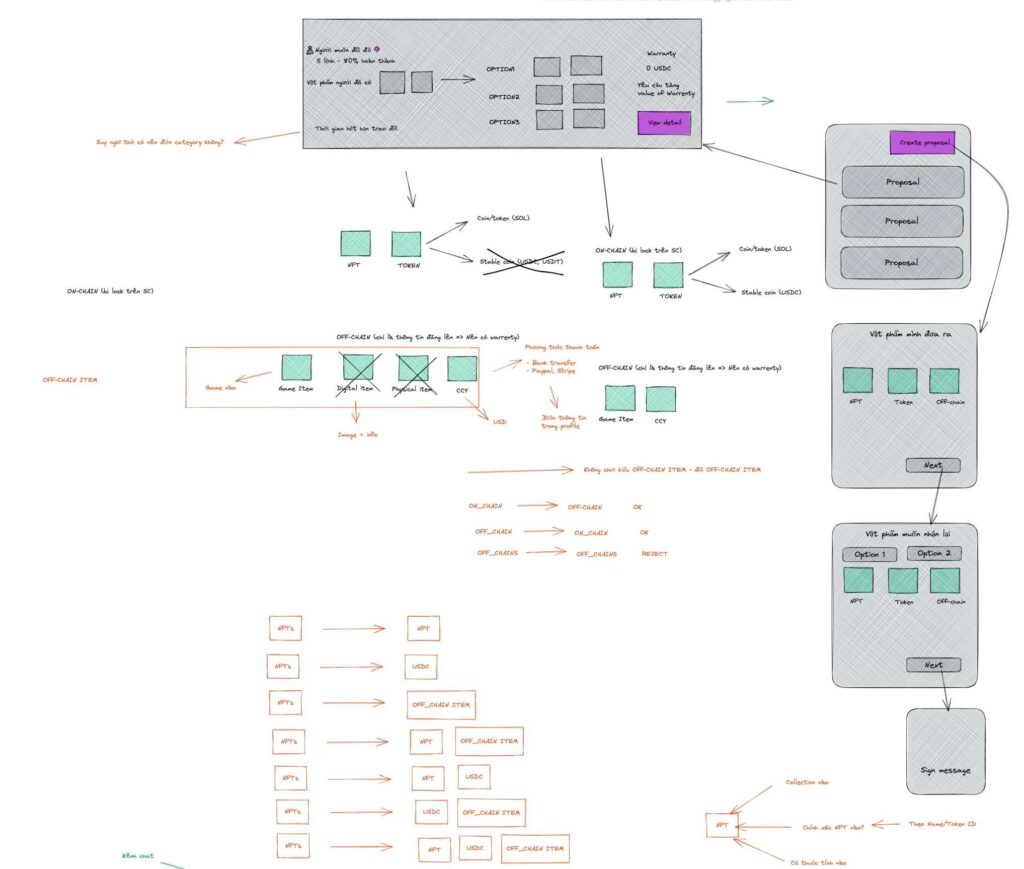

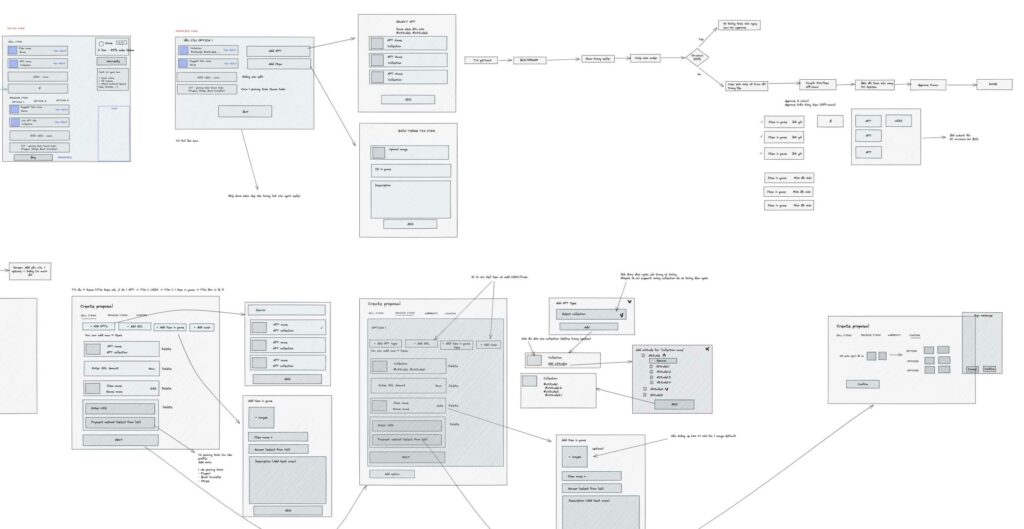

What features should I build more on pump.fun

Now on pump.fun, all projects are the same pattern, so if we can create the difference tokens

I suggest that you can build some thing more on this project such as:

- Allow user to adjust the decimals & max/total supply of tokens.

- Bonding curve options => creator can make the different type of price/curve on bonding curve

- Allow adjust the initial price

- Allow adjust the distribution

- Allow airdrop functional

- Support reflection.

- …

Conclusion

Yeah, you can learn about DEFI project by researching the hot/popular projects on blockchain.

Even you can copy their idea and build your own on another blockchain platform.

Example: I can find the awesome project that I can learn more: https://mint.club/